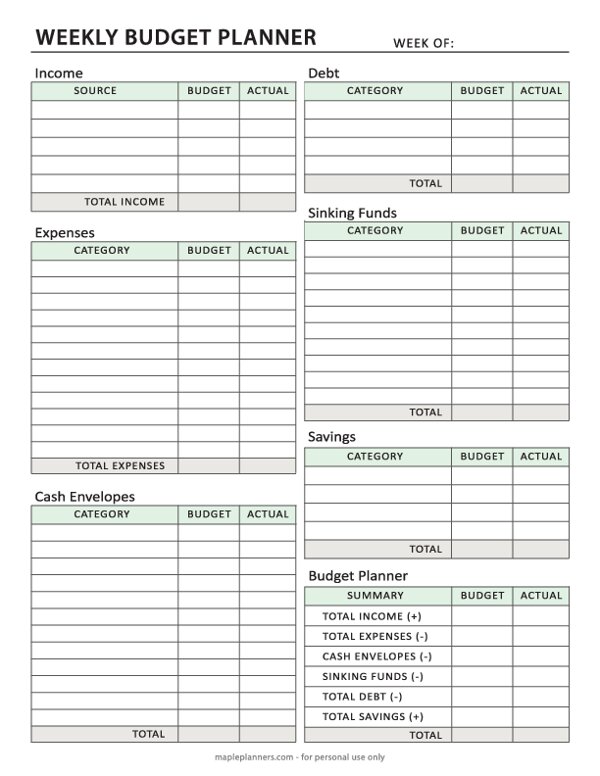

Weekly Budget Planner

Download free printable Weekly Budget Planner. For more similar Weekly Budget templates, browse our free printable library. Simply download and print them at home or office.

Scroll down for print and download options

The printable weekly budget planner helps you track your income and expenses each week and figure out where you can make changes to save money. So download the printable planner today and start creating a more financially secure future!

What is a Weekly Budget Planner?

A weekly budget planner is a printable document that you can use to track your income and expenses weekly. This can be helpful if you find it challenging to keep track of your spending monthly.

With this planner, you will see where you are spending most of your money and where you can cut back to save.

How to Use a Weekly Budget Planner

Using a weekly budget planner is simple. First, you will need to gather your income and expense information for the week. This can be done by looking at your bank statements, credit card bills, and any other records of your spending.

You will start by entering your income for the week. This can be your salary, any freelance work that you may have done, or any other source of income. After you have entered your income, you will begin to list your expenses.

Be sure to include everything, from your rent or mortgage payment to the cost of your daily coffee. Once you have all of your information in one place, you can begin to see where you spend most of your money.

Tips for Sticking to Your Budget

Once you have created your budget, it is important to stick to it as closely as possible. Here are a few ways to help you do just that:

- Make sure that you track your spending weekly. This will help you see where you are overspending and make adjustments as necessary.

- Try to stick to cash as much as possible. When you use cash, you are more aware of how much money you are spending.

- Avoid impulse purchases. If you see something you want, wait a day or two before buying it. This will give you time to decide if you need it or if you can live without it.

You should be able to stick to your budget and save money when you follow a system.