Monthly Check on Financial Goals

Download free printable Monthly Check on Financial Goals. For more similar Financial Goals templates, browse our free printable library. Simply download and print them at home or office.

Scroll down for print and download options

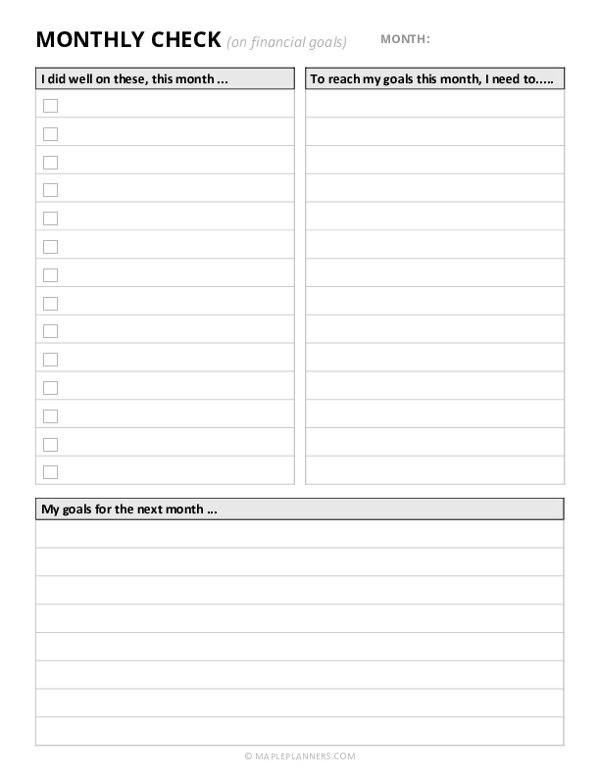

Keeping track of your financial goals is essential for maintaining long-term financial stability. You can achieve financial success by setting realistic financial goals, tracking progress, and utilizing a monthly check-in template.

Regular monthly check-ins, using the provided template not only help keep you on track but also allow you to see your progress over time.

1. Setting Realistic Financial Goals

To achieve financial stability, it’s essential to have realistic financial goals in mind. Many of us tend to set vague goals like ‘saving money’ or ’paying off debt’ that are hard to measure and track progress.

Setting specific and measurable goals like ‘reduce credit card balance by X amount’ or ‘pay down bills by a certain date’ will help you map out a clear plan to follow and track progress.

2. The Importance of Tracking Progress

If you want to stay motivated and on track, making your progress visible is essential. Regularly tracking your financial goals lets you see how far you’ve come and what you still need to do.

You can also reevaluate your approach or create new strategies based on what has or has not been successful. Regularly tracking your progress helps to keep you accountable and inspires you to work harder toward your financial goals.

3. Utilizing a Monthly Check-In Template

Tracking your finances is time-consuming, but with the help of a monthly checking template, you can do it in less time. This template gives you a clear idea of what you need to improve, such as if you’re overspending on particular categories or not contributing enough to reducing debt.

4. Keeping up with Monthly Check-Ins

Once you have your financial goals in mind and a tracking template, you must ensure that you keep up with monthly check-ins. Over time, your goals may change or adjust, and it’s essential to take those into account.

You can address new financial burdens, plan events, or make adjustments to your strategy. Monthly check-ins are a great opportunity to celebrate when you’ve achieved your goals, or you can re-strategize when things haven’t gone as planned.