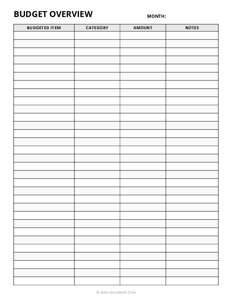

Monthly Budget Planner

Download free printable Monthly Budget Planner. For more similar Monthly Budget templates, browse our free printable library. Simply download and print them at home or office.

Scroll down for print and download options

A monthly budget planner template is an essential tool for managing your finances. It can help you take control of your money, set financial goals, and prioritize your spending.

Using a monthly budget planner template lets you take control of your finances and start living the life you want. So make sure to download our free monthly budget planner today and take the first step toward financial freedom.

You can use this template to track your income and expenses on a monthly basis with this template. Set your financial goals, prioritize your spending, and monitor your progress.

How can a monthly budget planner help you manage your finances?

A monthly budget planner template can help you manage your finances in several ways. It can;

- Provide a clear picture of your income and expenses. You can identify areas where you may be overspending by tracking your expenses and adjusting your spending habits accordingly.

- Help you set financial goals such as paying off debt, saving for the first car, down payment on a house, or retirement.

- Help you prioritize your spending and ensure that you spend your money on the most important things to you.

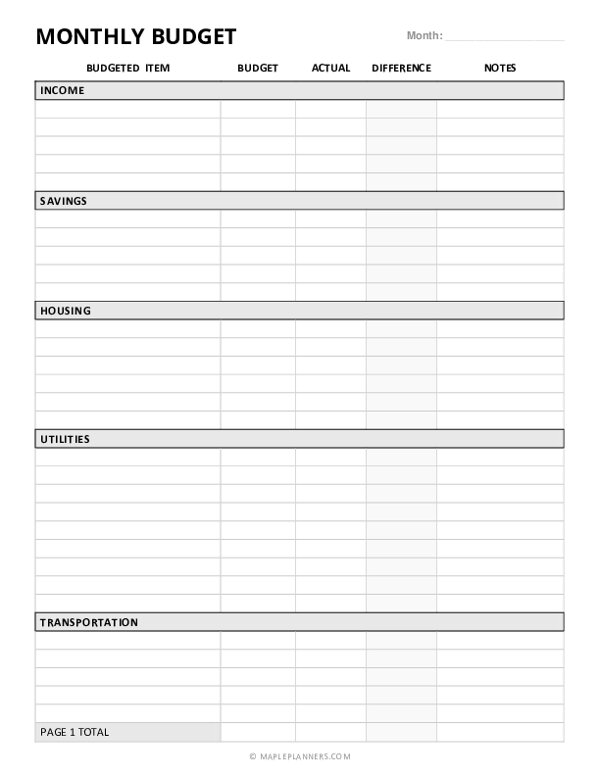

How to use a monthly budget planner template?

To use a monthly budget planner template:

- Start by filling in your income and fixed expenses such as rent, car payments, and utilities.

- Add in your variable expenses such as gas, entertainment, groceries, and travel.

- Subtract your expenses from your income to determine your monthly surplus or deficit.

- Use this information to adjust your spending habits, set financial goals, and prioritize your spending.

Other tips for managing your finances

In addition to using a monthly budget planner, several other tips can help you manage your finances.

- First, make a plan to eliminate debt. This can include creating a debt repayment plan and avoiding future debt.

- Second, save for emergencies by creating an emergency fund. This can help you avoid debt in the event of an unexpected expense.

- Third, save for the future by contributing to a retirement account such as an IRA or 401k.