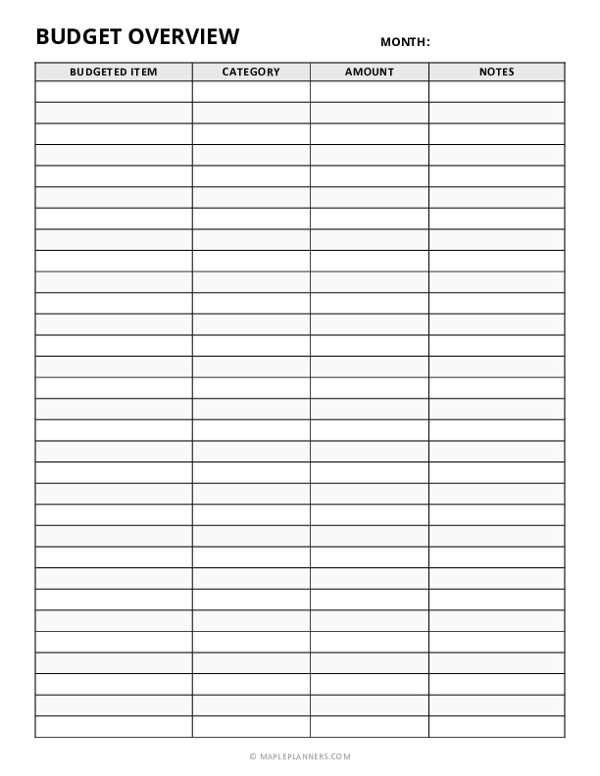

Monthly Budget Overview

Download free printable Monthly Budget Overview. For more similar Monthly Budget templates, browse our free printable library. Simply download and print them at home or office.

Scroll down for print and download options

Our monthly budget overview can help you manage your finances responsibly, achieve your savings goals, and pave the way to financial security.

The template is versatile and easy to use, and tracking your expenses can help you create positive changes in your spending habits. Download our template and make the most of your financial planning this month and beyond!

Benefits of using Monthly Budget Overview

Maintain Discipline and Track your Progress

One of the benefits of using a template is that it helps you maintain discipline and track your progress. Whether you're saving up for a big purchase or gradually erasing your credit card debt, our monthly budget overview will assist you in staying on track.

Set your monthly spending limits, keep track of your variable expenses, and compare your actual spending versus your planned expenses to ensure that you're on target with your goals.

Visibility into your gross and disposable income.

Your monthly budget overview also gives you visibility into your gross and disposable income. Knowing where your money is coming from and where it's going is crucial for financial stability and peace of mind.

Calculate your gross income by adding up your salary and any additional sources of income. Your gross income minus your fixed and variable expenses will give you your disposable income, which can be saved or put towards paying off debt.

Account for any irregular one time expense.

It helps you to account for any irregular or one-time expenses. This way, you can avoid going beyond your budget limits or being surprised by unexpected bills. Examples of irregular expenses may include birthday celebrations, car repairs, holiday presents, or home renovations.

Setting aside a dedicated budget for these scenarios ensures you're not jeopardizing your savings goals.

Evaluate your Lifestyle and Consumption Habits.

Our monthly budget overview allows you to evaluate your lifestyle and consumption habits. Reviewing your spending habits can be an eye-opening experience. It can help you become more aware of excessive expenses and lead you to reprioritize your money.

For example, if you're spending too much money eating out during the week, you may want to opt for meal prepping or bringing your lunch to work on some days. Don't underestimate the power of small changes in your behavior; they can add to big financial gains over time.

Saving money and keeping expenses in check isn't the easiest task. But, with a little effort and discipline, budgeting can become a painless habit that yields long-term benefits.